When most people start looking for a home, they’re likely to make a list of ideal locations, how many rooms they’d like and other must-haves for their property. Not too many will think about applying for a mortgage or what to prepare to make the process easier. To help prospective homeowners, in this part of the Mortgage Basics series, we’ll be looking at the mortgage application process, what you’ll need and what to expect.

Switching to MCAP

Looking for a new mortgage lender? You’ve come to the right place. We can help you find the right mortgage for your needs.

Why switch to MCAP?

Sometimes your needs change and switching lenders makes sense. Here are three reasons to help you make the switch to MCAP.

We are dedicated to helping our clients reach their home buying dreams.

Flexible Payment OptionsWe offer payment schedules and options to fit your lifestyle and goals.

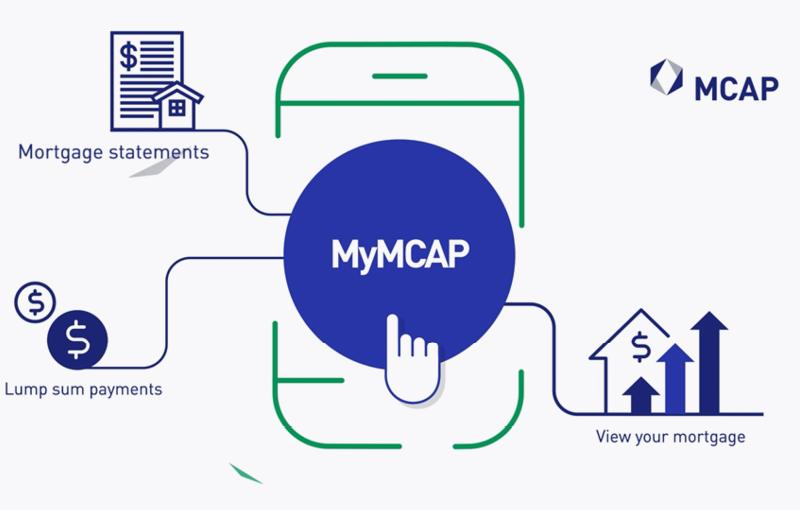

Online Self-Serve PortalOnce you’re an MCAP homeowner, take advantage of the MyMCAP homeowner portal to handle all your mortgage needs.

Why MCAP?

Paying your property taxes

MCAP offers the option to pay your property taxes with your MCAP mortgage, giving you one less bill to worry about.

Why use a mortgage broker?

Watch our quick video to understand the benefits of using a mortgage broker.

Pay down your mortgage faster

Get some tips on how to become mortgage-free faster.