Whether you’re looking to buy your first home, paying down your mortgage, or exploring how a rate change may impact your mortgage payments, the MCAP Mortgage Payment Calculator is a useful resource at all stages of your homeownership journey. In this blog, we’ll take a closer look at the different features of the calculator and how to use it to simplify homeownership in your situation.

How Are Mortgage Payments Calculated?

Mortgage payments are calculated using a formula that considers the loan amount, interest rate, and loan term. Each mortgage payment will include a portion that goes towards the principal balance of the loan and a portion that goes towards interest costs. At the beginning of your mortgage, you’ll notice more of the mortgage payment goes towards paying the interest but, over time, the amount going towards the principal will increase.

It’s important to note that our mortgage payment calculator does not include additional costs, such as property taxes, insurance, or mortgage insurance premiums.

Mortgage Calculator Details

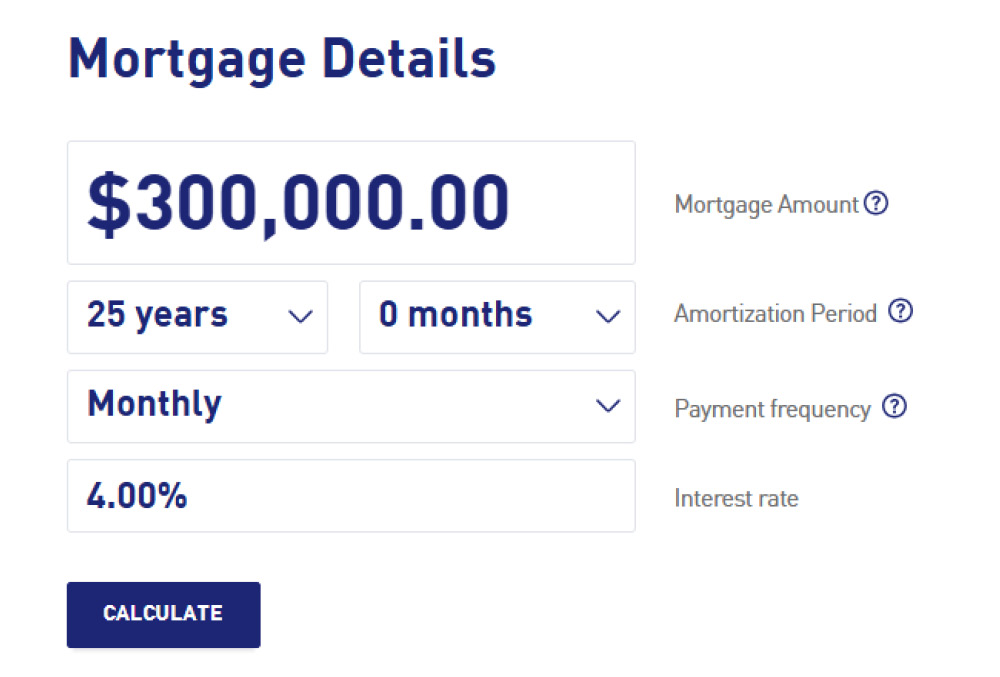

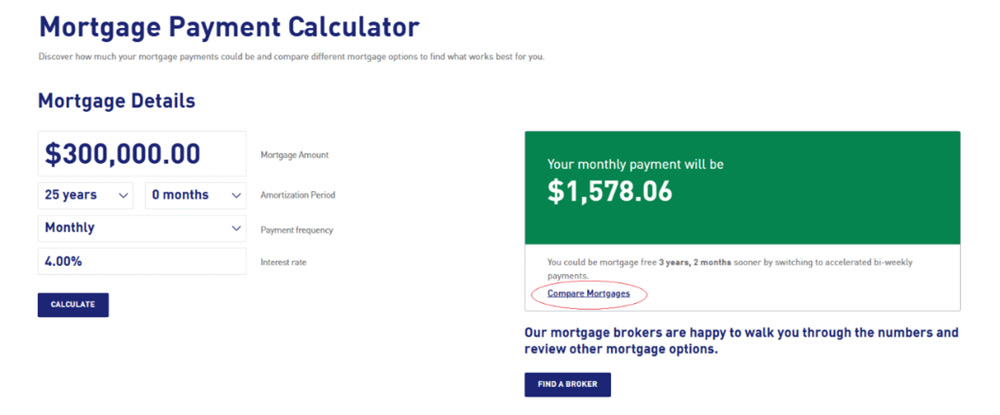

With the MCAP Mortgage Payment Calculator you’re able to calculate what your mortgage payment will be after inputting a few simple details.

Mortgage Amount: When buying a home, most purchasers will need a mortgage loan to cover the cost of the property in addition to their down payment. In this section, input the amount you intend to borrow to finance your new home.

Purchase Price ($800,000) – Down Payment ($200,000) = Mortgage Amount ($600,000)

Amortization Period: The amortization period refers to the length of time it would take to pay off your mortgage loan in full based on the agreed-upon terms in your mortgage contract. In Canada, the most common amortization period length is 25 years, but options range from 5 to 30 years.

Payment Frequency: Choose from a variety of options to fit your needs. Payment frequency options include weekly, accelerated weekly, bi-weekly, accelerated bi-weekly, semi-monthly and monthly.

What is an accelerated mortgage payment? |

What is an accelerated mortgage payment?Accelerated mortgage payments are calculated differently than normal mortgage payments, so you end up paying a bit more with each payment. After a year, these amounts total the equivalent of about 1 to 2 extra payments. |

Interest Rate: The interest rate you receive for your mortgage will make a big impact on the amount of interest you pay on your mortgage. Input your current, prospective or desired rate into this section to see how it could impact your mortgage payments.

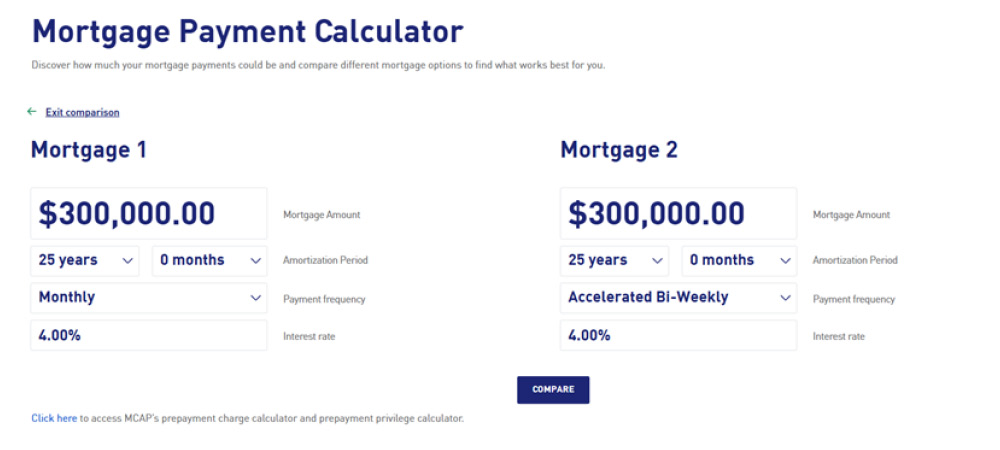

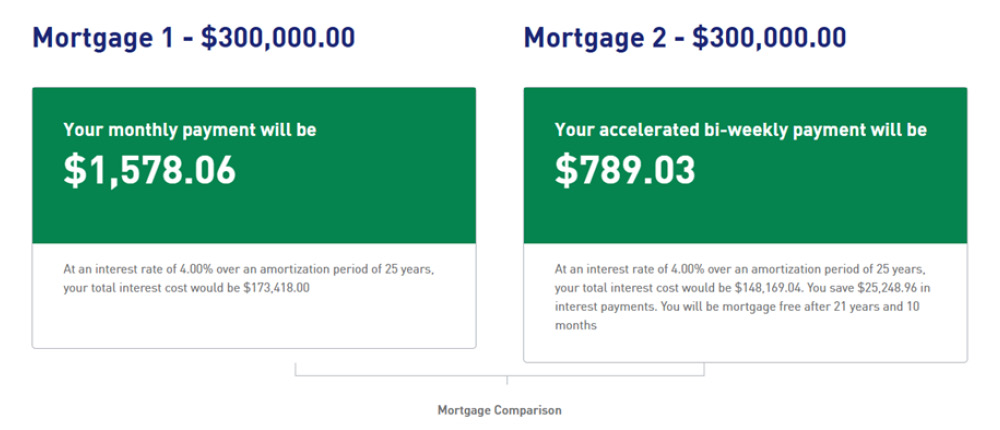

Compare Mortgage Payments

Ready to see how a few small changes can make a significant difference in your mortgage payments? Use the ‘Compare Mortgages’ feature of the calculator to see the difference between mortgage options side by side and gain valuable insights.

Different Ways to Use the Mortgage Payment Calculator

|

Preparing for your first or next home purchase: If you’re in the market for a new home, knowing how much you can afford to spend is a key factor in your decision. Based on the amount you have for your down payment, and the purchase price you’re looking at, what mortgage amount would allow for a reasonable payment that works for your budget? Do you need to save more for the down payment first or maybe find a home with a lower price point? |

|

Exploring options to pay off your mortgage faster: Paying off their mortgage faster is an aspiration most homeowners share. There are a few different strategies you can use to pay down your mortgage balance faster, from increasing your payment frequency to making lump sum payments. With the mortgage, calculator you can assess the different options and find a solution to help you reach a mortgage-free future a little sooner. |

|

Planning for a potential rate change: For those with an Adjustable Rate Mortgage (ARM), mortgage payments may change when the Bank of Canada announces a change to the prime rate. While you may not know the exact numbers in advance, working with a few different rates to determine the outcome and the impact on your payments will help you prepare, adjust your budget and consider your options. |

Try Out the Mortgage Calculator Today!

To find the calculator, visit our website and select ‘Residential Mortgages’, ‘Resources’ and then click ‘Mortgage Payment Calculator’. If you’d like some help as you explore your mortgage options and crunch numbers, our mortgage brokers would be happy to assist.