Buying a home is the most expensive financial purchase most people will make in their lifetime. For that reason, the mortgage interest rate you receive will make a big impact on how much you pay over the lifetime of your mortgage – even a difference of a single percent can amount to thousands of dollars. The down payment you make on your mortgage is an important factor that lenders will look at when determining what mortgage rate they will offer. Let’s explore the role your down payment plays in your mortgage rate options and how to position yourself for the best rate possible.

Key Takeaways- How a down payment impacts mortgage rates

- Benefits of a larger down payment when purchasing a home

- How to save for a down payment

What is a down payment?

When purchasing a home, the down payment is the initial amount of money that will be put towards the purchase of the property. This amount is usually paid in cash which can come from a variety of sources, such as savings, investments, or a gift from a family member. A mortgage lender will deduct the down payment amount from the purchase price of the home, and the mortgage amount will cover the remaining cost of the home.

In Canada, the minimum down payment amount is based on the purchase price of the property and ranges from 5 to 20% of the total purchase price.

| Purchase Price | Minimum Down Payment Amount |

| $500,000 or less | 5% of the purchase price |

| $500,000 to $1,499,999 |

|

| $1.5 million or more | 20% of the purchase price |

|

Purchase Price: $500,000 or less 5% of the purchase price |

$500,000 to $1,499,999

|

$1.5 million or more 20% of the purchase price |

Those who make a down payment of less than 20% of the purchase price of a property will require something called mortgage loan insurance which is provided by the Canadian Mortgage Housing Corporation (CMHC), Canada Guaranty, and Sagen. Mortgage loan insurance protects lenders in case borrowers are unable to make their mortgage payments. This will amount to an additional 0.60 – 4.00% of the total loan amount and is typically added to your mortgage payments by the lender or can be paid as a lump sum.

How Down Payments Impact Mortgage Rates

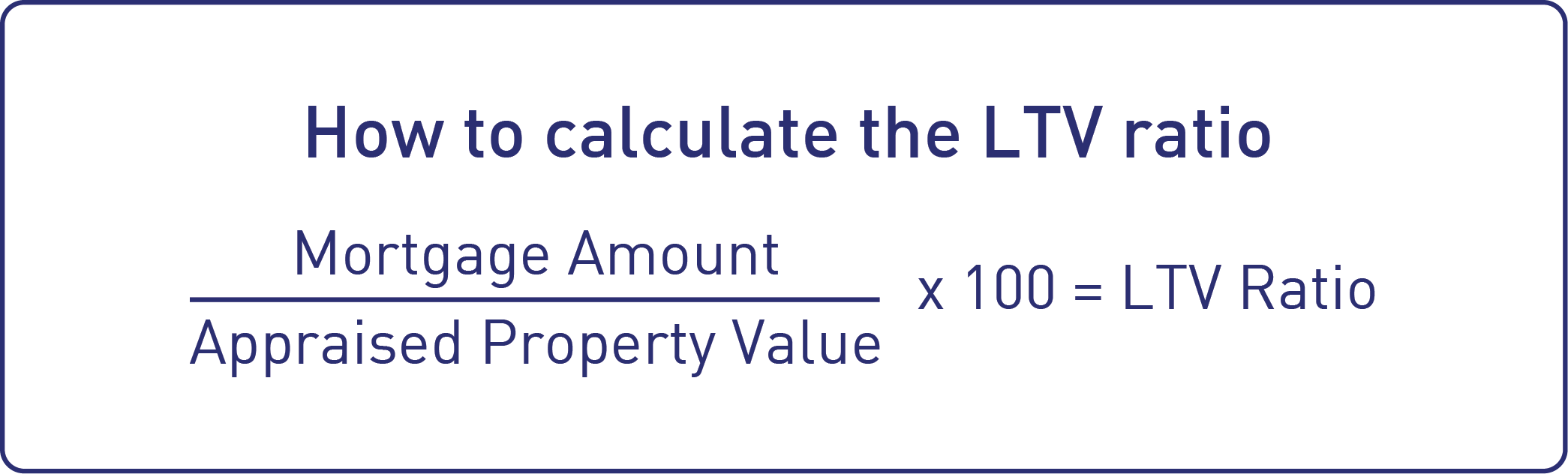

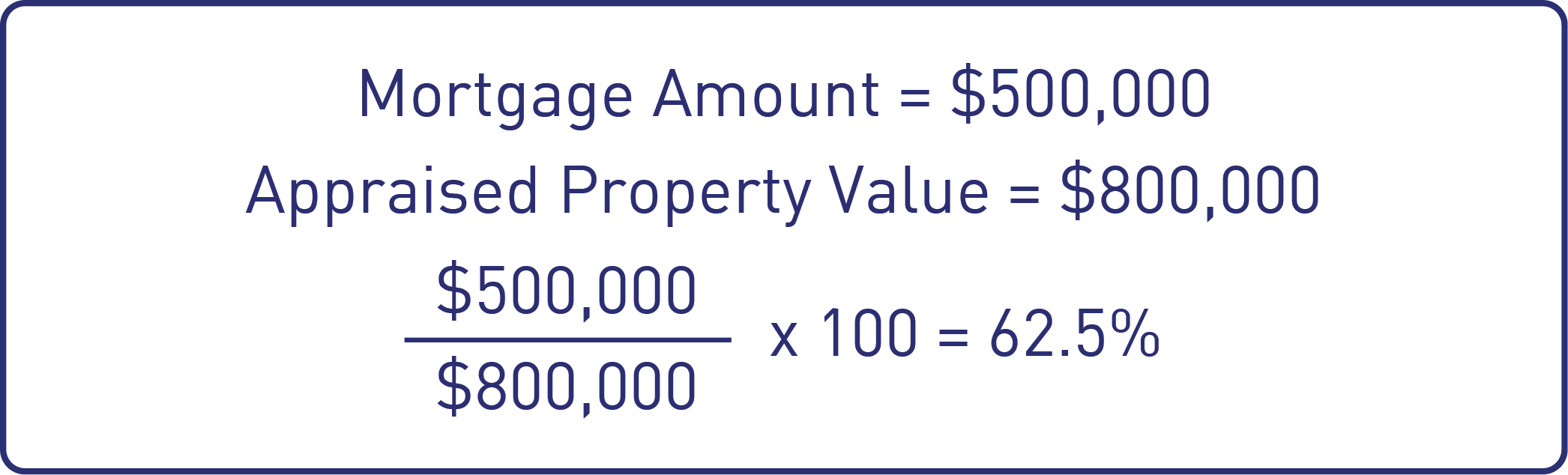

When determining what mortgage rate to offer borrowers, lenders will consider something called a loan-to-value (LTV) ratio. This ratio looks at the mortgage amount needed in comparison to the value of the property being purchased, and the mortgage needed is dependent on your down payment.

Let’s say you’re looking to purchase a property listed for $800,000 and you’ve saved a down payment of $300,000. You would require a mortgage loan of $500,000 to purchase the property.

An LTV ratio of 80% or more is considered a ‘high ratio’. From a lender’s perspective, a lower LTV ratio is considered less risky. If something were to happen, and a borrower was unable to pay their mortgage, there is less owed on the property that the lender has to recuperate. With a lower LTV ratio, there’s a greater likelihood of getting approved for a mortgage and getting a lower mortgage rate.

The Benefits of a Larger Down Payment

Save on mortgage loan insurance costs: With home prices at an all-time high, making even the minimum payment can be challenging. But, if possible, it’s worth putting more than the minimum down payment to avoid the extra cost associated with mortgage loan insurance.

Improved affordability: With a larger down payment you’ll have a lower mortgage loan balance to pay back. That means lower mortgage payments and less interest paid over the life of your mortgage.

More equity in your home: The initial equity in your home will be greater with a higher down payment which can give you access to things like a Home Equity Line of Credit that you can use towards other financial goals.

What About Lower Rates or Promotional Rates for High-Ratio Mortgages?

If you’ve been following mortgage rates over the past few years, you may have noticed lower rates or promotional rates targeted at high-ratio mortgages. Mortgage lenders are willing to offer lower rates on high-ratio mortgages because they are insured with mortgage insurance, which provides the lender assurance in the case that a mortgage defaults. While the lower rates that are occasionally offered for high-ratio mortgages may seem enticing, it’s important to look at the full picture.

By putting down less than 20% of the purchase price you may be eligible for a lower rate, but there is the added cost of mortgage loan insurance as well as the extra interest you will have to pay since your mortgage loan amount is higher. Before you opt for a low rate on a high-ratio mortgage, break down all the costs to see if it makes sense for you.

→ Try our Mortgage Payment Calculator

How to Save for a Larger Down Payment

With planning, budgeting and by using your resources, you can save for a down payment and reach your homeownership goals sooner. Whether you decide to put your down payment savings in a Registered Retirement Savings Plan (RRSP), a Tax-Free Savings Account (TFSA), the newly introduced Tax-Free First Home Savings Account (FHSA), or all three, you can benefit from tax-free growth on your hard-earned savings.

Don’t forget!

Your down payment is just one aspect that lenders will look at when they’re determining your mortgage rate. Other factors that will help you get the best possible rate are your credit score, debt-to-income ratio, and employment history.

Conclusion

Your down payment is an important part of your homeowner journey and will impact potential mortgage rates, monthly payments and how much you’re paying over the lifetime of your mortgage. As you save for your down payment on your future home, feel free to reach out to one of our knowledgeable mortgage brokers to discuss mortgage options that could work for you!