For many homeowners, paying off their mortgage is one of their biggest financial goals. It’s a great accomplishment to strive for and with the right knowledge, tools and financial discipline, it’s definitely achievable.

Benefits of paying off your mortgage:

|

Financial flexibility: Your mortgage payment is likely your largest household expense so paying off your mortgage allows you to prioritize other financial goals. |

|

Pay less in interest over time: By paying your mortgage off faster, you’re able to save on the interest that would’ve been charged during the lifetime of your mortgage loan, potentially saving you thousands of dollars. |

|

Increased home equity: As you pay off your mortgage, the equity in your home increases too. This gives homeowners the option to access their home equity through things like a Home Equity Line of Credit to help them achieve other goals like renovations or buying a second property. |

Understanding Mortgage Payments

Mortgage payments are generally broken down into two parts, principal and interest. How much of your payment goes towards each part will change throughout the lifecycle of your mortgage, with a larger portion going towards interest in the early stages of your mortgage.

The good thing is that additional payments made to your mortgage above your regular payment amount will typically be applied to the principal1, decreasing your mortgage loan amount.

Methods to Pay Off Your Mortgage Faster

1. Accelerate Your Mortgage Payments

Monthly mortgage payments are the most common payment frequency but they’re not the only option. By increasing your payment frequency and taking advantage of accelerated payment options, you can pay off your mortgage faster and pay less in interest.

What is an Accelerated Mortgage Payment?

Accelerated weekly or biweekly payments are calculated differently than regular weekly and biweekly payments

Weekly

Regular Payment: 1 payment per month (monthly payment x 12 ÷ 52)

Accelerated Payment: 1 payment per month (Monthly payment ÷ 4 x 52)

Biweekly

Regular Payment: 2 payments per month (monthly payment x 12 ÷ 26)

Accelerated Biweekly Payment: 2 payments per month (Monthly payment ÷ 2 x 52)

It’s a subtle difference but it amounts to big savings!

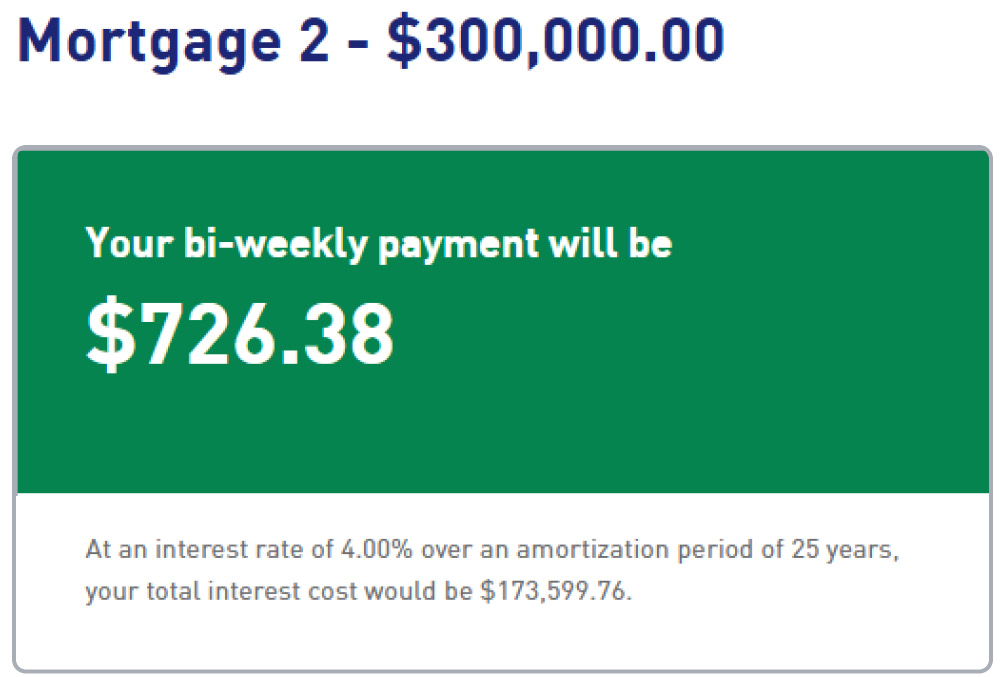

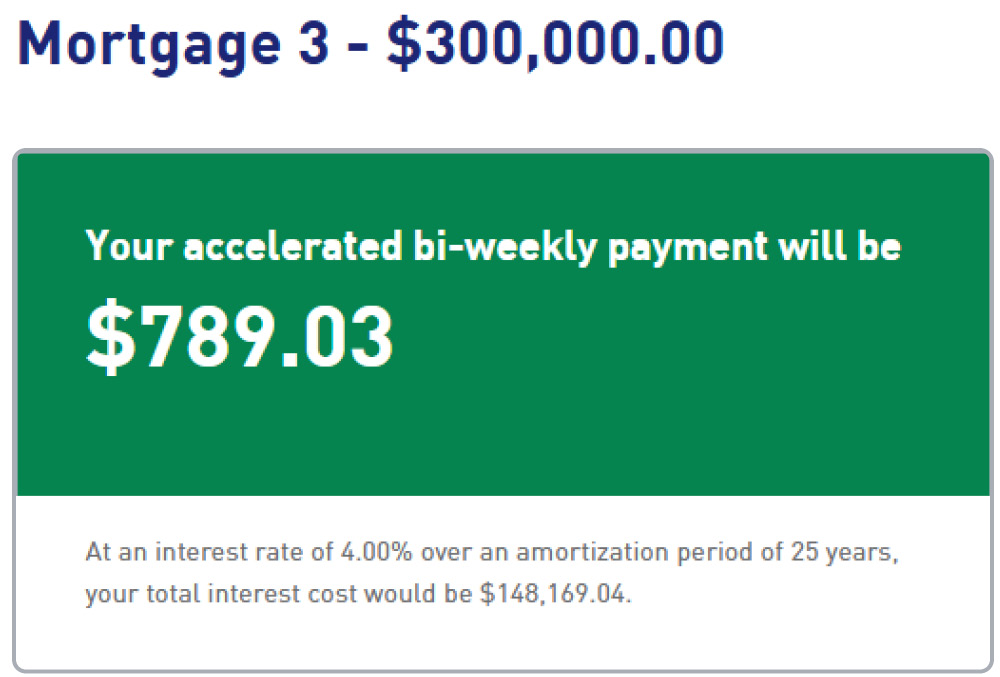

Let’s calculate mortgage payments and total interest costs on a $300,000 mortgage at an interest rate of 4.00% and an amortization period of 25 years.

As you can see, the difference between the monthly and biweekly payment in terms of the total interest cost is minimal but you end up paying more with the biweekly payments.

On the other hand, the total interest saved with the accelerated biweekly payments is significant at $25,430.72 and shaves just over three years off the length of the mortgage making it a great option for those looking to pay off their mortgage faster.

2. Put Your Pre-Payment Privileges to Use

Prepayment privileges allow borrowers to put more money towards paying off their debt without incurring a fee or penalty2. Depending on your mortgage agreement, you may be able to increase your mortgage payments between 10 to 25%. Similar to accelerated mortgage payments, the extra amount paid will steadily chip away at your mortgage balance over time.

| Small Changes, Big Impact | Try rounding up your mortgage payments! With a small increase, you’ll pay down your mortgage faster without having to make any drastic lifestyle changes. For example, if your mortgage payment is $726.38, round it up to $750. |

3. Leap Ahead with Lump Sum Payments

Making a lump sum payment towards your mortgage is a smart tactic to help homeowners become mortgage-free sooner. This is an especially good method for those who may have come into an extra source of income, like an inheritance, tax refund, or work bonus. The funds will go directly towards paying the principal of the mortgage and it won’t impact your regular budget.

To learn more about lump sum payments, take a look at this useful article.

4. Decrease Your Amortization

Amortization is the amount of time it would take to fully pay off a mortgage based on the agreed upon details in the mortgage agreement, such as the interest rate and payment schedule. While most Canadians select a 25-year amortization, opting for a shorter amortization period will help homeowners save a significant amount in interest over the life of their mortgage.

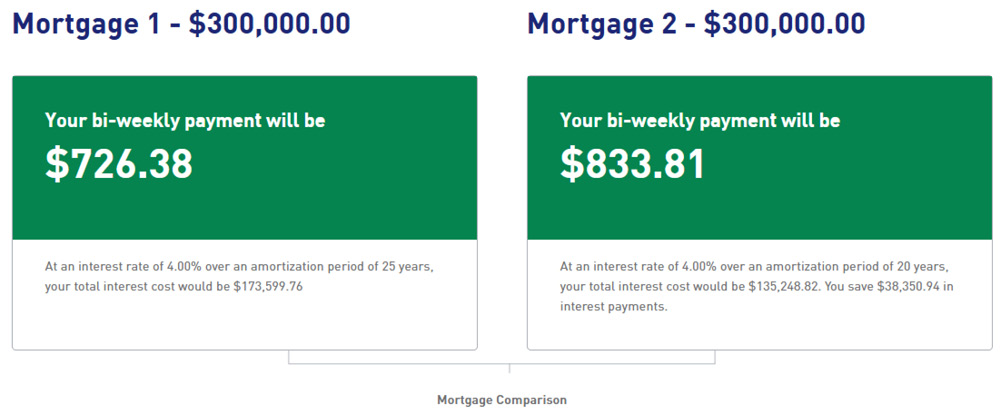

Using the same mortgage details from our previous example, let’s compare a 25-year amortization period with 20 years.

Although the bi-weekly payments are higher, the mortgage is paid off five years sooner which means 5 less years of interest on the mortgage loan amount.

5. Secure A Great Rate

One of the biggest factors that will impact how much you pay on your mortgage is the interest rate. If you’re already locked into a mortgage term, you won’t be able to make changes to your mortgage rate unless you refinance your existing mortgage which can come with a few added costs.

When it’s time to renew your mortgage, at the end of your term, you’ll be able to explore mortgage rates and different mortgage features, like the prepayment privileges we looked at earlier. This is a great time to secure the best rate to ensure you’re paying less in interest on your mortgage. Here’s a checklist to help you prepare for a mortgage renewal.

Is Paying Off a Mortgage Early Right for Everybody?

Paying off a mortgage is a huge accomplishment for any homeowner, and while it’s a great goal to strive towards, paying off a mortgage early may not be the best option for everyone. Depending on your financial situation and priorities, it may make sense to put off paying down your mortgage faster to tackle other goals like paying off high-interest debt (credit cards, personal loans, etc.) or building an emergency fund. Assess your situation and make the best decision based on your goals and objectives.

Make a Mortgage-Free Future a Reality

We hope these tips help you on your journey to becoming mortgage-free even sooner! If you’re an existing MCAP homeowner, feel free to contact us to explore options to help you on your way.

1 Before making additional payments to your mortgage, check your mortgage agreement to confirm your prepayment privileges, penalties and how additional payments will be applied to your mortgage

2 Prepayment privileges vary depending on the lender and type of mortgage product you have so it’s best to confirm your prepayment options in your mortgage agreement before making any changes.